Did you know nearly 80% of Americans live paycheck to paycheck? They struggle to make ends meet. This highlights the need for a better way to manage money. The 50/30/20 rule is a budgeting technique that can help you control your finances and reach your goals.

In this guide, we’ll dive into the 50/30/20 rule. It’s a system that has changed how millions manage their money. It’s great for paying off debt, building an emergency fund, or understanding your spending. The 50/30/20 rule is the guide you’ve been looking for.

By the end of this article, you’ll know how to budget like a pro. Your money will work as hard as you do. Let’s start and discover the secrets to financial freedom with the 50/30/20 rule.

The 50/30/20 Rule: How to Master Budgeting Like a Pro

Budgeting might seem hard, but it’s a key to financial planning and money management. The 50/30/20 rule is a simple yet effective way to manage your income. It helps you reach your personal finance goals.

Understanding the Basics

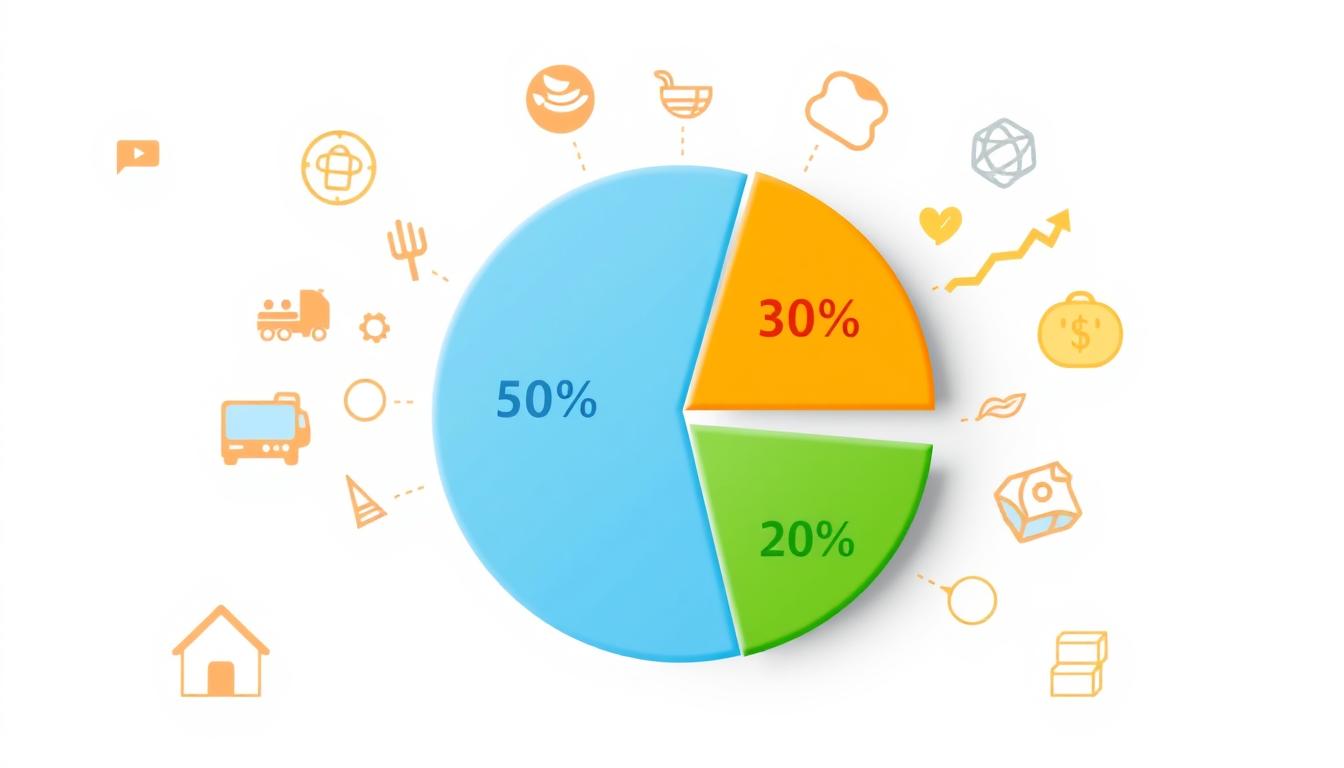

The 50/30/20 rule splits your income into three parts:

- 50% for essential expenses, like housing, utilities, and groceries

- 30% for discretionary spending, for dining out, entertainment, and personal care

- 20% for savings and debt reduction

Why the 50/30/20 Rule Works

This rule is great because it balances budgeting and expense tracking. It makes sure you cover your basic needs with 50% of your income. The 30% for discretionary spending lets you enjoy life without spending too much.

The 20% for savings and debt repayment helps you build financial strength. It helps you reach your long-term goals.

“The 50/30/20 rule is a simple yet effective way to take control of your finances and achieve your financial dreams.”

By using the 50/30/20 rule, you can improve your savings strategies and debt reduction. This way, you can become a pro at budgeting.

Needs vs. Wants: Prioritizing Essential Expenses

Effective budgeting starts with knowing the difference between needs and wants. By sorting your expenses, you make sure your must-haves are paid first. Then, you can spend on things you want but don’t need. This is the core of the 50/30/20 budgeting rule.

Your needs are the basic, must-have costs for living well and daily needs. These include your home, bills, food, and health care. Your wants, however, are things you’d like but don’t have to have.

To focus on what’s essential, start by listing all your monthly costs. Then, sort each one as a need or a want. This helps you see where your money goes and where you can cut back.

“The first step to taking control of your finances is understanding where your money is going. Categorizing your expenses as needs and wants is a game-changer in budgeting.” – Financial Planner, Jane Doe

After knowing your needs and wants, you can plan your income better. Make sure your essential costs are met before spending on discretionary items. This step is key to using the 50/30/20 rule well and keeping your finances stable.

Maximizing Your Budget with the 50% Rule

The 50% rule is a key tool for managing your money. It helps you plan your finances well. By spending 50% of your income on needs, you can balance your budget. Let’s look at how this rule affects your finances.

Housing and Utilities

Housing and utilities are big parts of your monthly costs. Try to keep these under 50% of your income. Look for ways to save, like finding cheaper housing or using less energy.

Transportation Costs

Transportation is also a big expense. It includes car costs, public transit, and more. By tracking and planning your spending, you can save money. Try carpooling or using public transit to cut costs.

Groceries and Daily Necessities

Use part of your 50% for food and daily needs. Plan your shopping to save money. Choose affordable, healthy foods to make the most of your budget.

The 50% rule is just a guide. Your budget needs may differ. By watching your spending, you can make the most of this rule. This helps you manage your finances better.

Lifestyle Spending: The 30% Allocation

The 50/30/20 rule helps you manage your money well. It lets you spend 30% on things you enjoy. This way, you can have fun without hurting your financial plans.

Dining Out and Entertainment

Dining out and having fun are key to a good life. Spending some of your money on these things helps you relax and enjoy life. But, make sure you don’t spend too much.

Personal Care and Hobbies

Looking after yourself and hobbies are vital. They help you feel good and can be part of your spending plan. Things like gym memberships or hobbies should be included in your 30% for fun.

The 50/30/20 rule is just a guide. It’s important to adjust it to fit your own money situation. By planning your 30% for fun, you can live well and still manage your money.

| Expense Category | Recommended Allocation |

|---|---|

| Dining Out | 10-15% of 30% discretionary budget |

| Entertainment | 10-15% of 30% discretionary budget |

| Personal Care | 5-10% of 30% discretionary budget |

| Hobbies | 5-10% of 30% discretionary budget |

“The secret of getting ahead is getting started. The secret of getting started is breaking your complex overwhelming tasks into small manageable tasks, and then starting on the first one.”

By using the 50/30/20 rule, you can control your money and live a happy life. You won’t have to give up your dreams for money.

Building Financial Resilience: The 20% Savings Rule

In the 50/30/20 budgeting framework, 20% goes to building financial resilience. This part of your budget helps you save for emergencies, retirement, and debt repayment. It prepares you for the future.

Emergency Fund

An emergency fund protects you from sudden expenses. Save a part of your 20% for unexpected costs like medical bills or car repairs. Aim for 3-6 months’ worth of essential expenses.

Retirement Savings

Retirement savings are key for financial security later in life. Use a part of your 20% for a 401(k) or IRA. This helps your money grow tax-free and compound over time.

Debt Repayment

Reducing high-interest debt improves your financial health. Use some of your 20% to make extra payments on debts. Start with the ones that charge the most interest. This saves you money and boosts your credit score.

Using the 20% savings rule builds a strong financial base. It helps you face unexpected challenges and reach your long-term goals. Stay consistent and disciplined in your budgeting techniques, financial planning, and money management.

Adapting the 50/30/20 Rule to Your Unique Situation

The 50/30/20 rule is a good start for budgeting techniques. But, everyone’s financial planning and money management needs are different. Adapting this rule to fit your life can help you reach your goals.

When it comes to expense tracking and savings strategies, one size doesn’t fit all. Think about your income, where you live, your lifestyle, and debt reduction needs. Changing the percentages for needs, wants, and savings can make your budget better for you.

- If your housing costs are higher than 50%, you might need to spend more on housing.

- Big debt might mean you can’t save 20% each month.

- If you spend less than 30% on lifestyle, you could save or pay off debt more.

Being flexible and adjusting your budget as needed is key. Regularly check and tweak your budget to keep on track. This ensures your money management plans stay effective.

“The 50/30/20 rule is a great starting point, but ultimately, your budget should reflect your unique financial needs and goals.”

By customizing the 50/30/20 rule for your life, you can make a budgeting plan that helps you reach your financial dreams. This plan will help you build a more secure financial future.

Budgeting Tools and Apps for Seamless Tracking

Using budgeting tools and apps can change the game when following the 50/30/20 rule. These digital tools make tracking and managing money easier. They give us real-time insights, helping us stay organized and on track with our budget.

YNAB (You Need a Budget) is a great choice for following the 50/30/20 rule. It helps us spend mindfully by categorizing expenses into “Needs,” “Wants,” and “Savings.” This makes it easy to see how we’re allocating our money.

Mint is another powerful tool. It connects to your bank accounts and credit cards, automatically sorting your spending. Mint’s dashboards and reports make it simple to track your budgeting techniques, expense tracking, and savings strategies.

| Budgeting App | Key Features | Pricing |

|---|---|---|

| YNAB |

|

$14.99/month or $98.99/year |

| Mint |

|

Free |

Adding these budgeting tools and personal finance apps to your routine can make managing money easier. They help us track our money management and stay on top of our financial planning. These tools empower us to follow the 50/30/20 rule smoothly, leading to a more secure financial future.

Overcoming Budgeting Challenges

Every budgeting system faces challenges, and the 50/30/20 rule is no different. We’ll tackle common hurdles like irregular income and unexpected expenses. We’ll share practical ways to beat these challenges and keep your budget on track.

Dealing with Irregular Income

For those with income that changes, like freelancers or entrepreneurs, budgeting gets tricky. Here are some tips to manage income that’s not steady:

- Start with a budget based on your lowest income and adjust when you earn more.

- Put any extra money into savings or debt repayment, not on spending.

- Save enough for an emergency fund to cover a few months of bills.

- Use budgeting apps that can handle income changes and show how you spend.

Handling Unexpected Expenses

Life is full of surprises, and unexpected costs can upset your budget. Here’s how to prepare for the unexpected:

- Keep an emergency fund for big, unplanned bills like medical or car repairs.

- Work on paying off debt to have more money for emergencies.

- Check your insurance to make sure you’re covered for risks.

- Make your budget flexible to handle unexpected costs.

By tackling these common budgeting challenges, you can create a strong financial plan. Remember, the secret to good budgeting techniques, financial planning, and money management is being flexible and ready to change your plan as needed.

Incorporating the 50/30/20 Rule into Your Financial Plan

The 50/30/20 rule is more than just a budgeting technique. It’s a way to manage money that leads to long-term financial stability. By using this rule in our financial plan, we make sure our budgeting and savings match our goals.

To add the 50/30/20 rule to our financial plan, we need to know our current financial situation. We must also set short-term and long-term goals. Then, we can divide our income based on these goals.

By using 50% of our income for essential expenses, 30% for lifestyle spending, and 20% for financial resilience, we create a balanced plan. This plan helps us manage our money well and reach our personal finance goals.